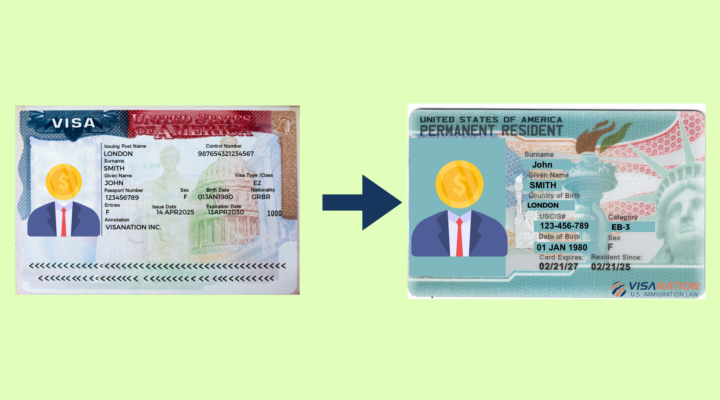

Your Path to the United State: Comprehending E2 Visa Financial Investment Advantages and needs

The E2 Visa works as a sensible avenue for foreign capitalists seeking to develop a foothold in the united state economy with service endeavors. Comprehending the investment requirements and qualification requirements is essential for those considering this course, as it involves specific economic commitments and functional requireds. In addition, the advantages related to this visa can considerably enhance one's business prospects in the United States. Numerous prospective financiers stay unclear about the nuances of the application process and the kinds of financial investments that qualify. Discovering these components can offer important insights for possible applicants.

What Is the E2 Visa?

The E2 visa is a non-immigrant classification that allows international nationals from treaty countries to enter the United States to spend in and handle a company. This visa is especially made for individuals who seek to add resources to a united state venture, consequently stimulating financial growth and producing work possibilities. The E2 visa is particularly appealing as a result of its flexibility and the potential for renewal, as long as the company stays functional and fulfills the necessary demands.

To qualify for the E2 visa, candidates should show a substantial investment in a bona fide enterprise. This financial investment needs to be sufficient to guarantee the service's stability and success. The E2 visa can be released for an initial period of up to 2 years, with the opportunity of expansions in increments of two years, allowing investors to preserve their standing as long as they satisfy the conditions of their financial investment and service operations.

Along with the investment aspect, the E2 visa permits the incorporation of member of the family, consisting of spouses and children, that can come with the primary capitalist to the United States. This aspect boosts the advantages of the E2 visa as a path for individuals seeking to develop roots in the U.S. with entrepreneurial ventures.

Qualification Criteria

To get an E2 visa, capitalists should meet details requirements that encompass numerous elements of their company undertakings. This consists of an analysis of the investor's certifications, the nature of business they mean to operate, and the needed investment amount. Comprehending these elements is important for prospective candidates aiming to safeguard this visa successfully.

Capitalist Certifications Summary

Several individuals looking for E2 visa standing must satisfy certain qualification standards to qualify as capitalists. Mostly, candidates must be nationals of a nation that has a treaty of business and navigating with the USA. This requirement assurances alignment with U.S. international policy and financial interests.

An additional important requirement is the investment quantity, which should be considerable sufficient to establish and operate a sensible business. While no fixed minimum financial investment is stated, amounts usually vary from $100,000 to $200,000, depending upon the nature of the business. The financial investment must show a dedication of funding, risk of loss, and possibility for earnings.

Moreover, the investor should hold a minimum of 50% possession of the company or possess functional control via various other ways, such as a supervisory setting. It is likewise vital that the service is not marginal; it needs to create sufficient earnings to sustain the investor and their family.

The candidate needs to show that the funds being invested are obtained with legal means, ensuring conformity with United state lawful requirements. Fulfilling these credentials is essential for a successful E2 visa.

Business Kind Factors To Consider

Selecting the suitable service type is a crucial consider meeting E2 visa eligibility standards. The E2 visa is especially created for capitalists that desire to develop and direct the procedures of a business in the United States. USA Visa E2. To qualify, the service must be a bona fide enterprise, which normally suggests it ought to be an actual, active commercial venture generating products or solutions commercial

Particular kinds of companies are a lot more favorable for E2 visa applicants. Usually, service-based organizations, retail operations, and certain production ventures are thought about eligible. The company must ideally demonstrate potential for growth and task creation, which can boost the financier's application. Additionally, passive investments, such as property or supply financial investments, do not get E2 condition, as they stop working to satisfy the need for energetic involvement in the service.

In addition, business should be structured as a legal entity in the U. E2 Visa Requirements.S., such as a company or limited liability firm (LLC) This legal structure not only offers liability security but additionally develops the authenticity of the investment, thus meeting an essential requirement for E2 visa eligibility. Choosing the ideal service type is as a result important for an effective application

Investment Quantity Needs

The financial investment quantity is a crucial part of the E2 visa qualification requirements, as it straight influences an applicant's capacity to develop a practical organization in the United States. While the U.S. government does not specify a minimal investment amount, the requirement usually determines that the financial investment must be significant in relationship to the overall expense of establishing the company or buying.

Commonly, investments ranging from $100,000 to $200,000 are common, although reduced amounts may serve depending upon the nature and feasibility of the enterprise. The funds should go to risk, meaning they must be irrevocably devoted to business and not merely held as collateral or aside.

The financial investment must be enough to assure the organization's success and be qualified of creating sufficient revenue to support the financier and their household. The sort of company can also influence the investment need; for instance, a startup may need a different amount than a franchise business or an existing service acquisition. Eventually, applicants have to show that their financial investment suffices to produce a sustainable business, aligning with the E2 visa's intent to advertise financial development in the USA.

Financial Investment Amount Requirements

When thinking about the E2 visa, understanding the investment quantity needs is important. Applicants need to meet a minimal financial investment threshold, which differs depending upon the nature of business. Additionally, it is necessary to give clear documentation concerning the resource of funds to ensure compliance with U.S. immigration policies.

Minimum Investment Limit

For those thinking about the E2 visa, recognizing the minimal investment limit is necessary to making certain compliance with U.S. immigration guidelines. The E2 visa does not specify a certain dollar amount for the financial investment; nevertheless, the financial investment needs to be considerable in regard to the cost of the company. Generally, a minimal financial investment of $100,000 is commonly cited as a standard, particularly for companies in affordable industries.

The key factor to consider is that the financial investment needs to suffice to establish and run a feasible venture. This indicates the funds should be at danger and dedicated to business, demonstrating the investor's objective to actively take care of and develop the venture. In addition, the investment should offer a considerable contribution to the U.S. economic climate, frequently assessed by the work development potential for U.S. employees.

Investors should likewise know that lower investment quantities may be appropriate for certain organizations, particularly those in much less capital-intensive industries (Treaty Countries). Ultimately, the details investment quantity will rely on the nature of the company and its operational needs, enhancing the value of extensive preparation and financial evaluation prior to application

Source of Funds

Establishing the source of funds for an E2 visa investment is a vital aspect of the application process, as it assures that the investment is legit and traceable. U.S. immigration authorities call for candidates to demonstrate that the funds made use of for the financial investment have been obtained via legal methods, making sure conformity with anti-money laundering policies.

To satisfy this need, applicants should provide comprehensive documentation that plainly illustrates the beginning of their investment resources. This might consist of financial institution statements, tax returns, pay stubs, or sales arrangements, reflecting the buildup of funds in time. It is necessary to offer a clear economic background, detailing just how the funds were acquired, whether via individual savings, organization earnings, or lendings from identified financial institutions.

Additionally, applicants must be prepared to attend to any type of prospective red flags, such as unexpected increases of huge sums, which might increase suspicions. A well-documented source of funds not only strengthens the E2 visa yet also enhances the applicant's integrity. Inevitably, making sure the authenticity of the financial investment is paramount for an effective shift to developing a service in the United States.

Types of Qualifying Investments

Qualifying financial investments for the E2 Visa can take various kinds, each customized to fulfill specific requirements established by the united state government. The key need is that the investment must be enough and considerable to guarantee the successful operation of the company. This frequently includes a minimum investment threshold, usually beginning around $100,000, yet the exact amount can differ based on the nature of the business.

One typical form of qualifying financial investment consists of the acquisition of an existing organization, where the capitalist gets functional possessions and takes over monitoring. Conversely, starting a brand-new organization can also certify, offered that business strategy demonstrates practicality and possibility for development.

Additionally, investments in tangible properties like equipment, inventory, or realty utilized in the company are acknowledged as qualifying investments. Totally easy financial investments, such as acquiring bonds or stocks, do not meet E2 Visa needs. The investment must be at threat and actively involved in the company operation, ensuring that the investor plays an important function in its success. Understanding these investment types is necessary for possible E2 Visa applicants to navigate the procedure efficiently.

Company Ownership and Control

The candidate must have the ability to direct the business and establish's operations. This means that they need to hold an exec or managerial position, allowing them to influence the daily organization choices. If the organization is a company or a partnership, the financier ought to additionally be actively associated with its administration, showcasing their commitment and beneficial interest in the success of the endeavor.

Paperwork is essential in establishing ownership and control. This usually includes business charts, operating arrangements, and records that information the financier's function and contributions. Clear evidence of control strengthens the E2 copyright, as it highlights the investor's active participation, consequently aligning with the visa's intent to promote economic growth and task creation in the U.S.

Benefits of the E2 Visa

The E2 Visa supplies a variety of advantages that make it an appealing option for international capitalists seeking to take care of a business or develop in the USA. Among the main advantages is the capacity to work and live in the united state while proactively taking care of the investment. This visa enables an adaptable period of keep, as it can be renewed indefinitely, gave the company continues to be operational and meets the visa needs.

Additionally, E2 Visa holders can include their immediate family members, enabling partners to function and youngsters to participate in college in the U.S. This develops a helpful atmosphere for family members moving for company objectives. One more considerable benefit is the fairly low financial investment threshold compared to other visa categories, enabling a broader array of capitalists to certify.

The E2 Visa likewise grants access to a varied and durable market, providing chances for networking and company growth. Unlike various other visa kinds, there are no annual caps on E2 visas, which suggests that candidates may face much less competition. On the whole, the E2 Visa offers a practical pathway for international business owners seeking to increase their company horizons in the USA.

Application Process Review

Navigating the application process for the E2 Visa needs mindful preparation and interest to information. The first action is to evaluate qualification, making certain that you are a nationwide of a treaty nation and have the requisite financial investment quantity in a certified enterprise. Following this, applicants must develop an extensive service plan that outlines the financial and operational elements of the recommended venture, showing its viability and possibility for growth.

When business plan is wrapped up, the following step is to collect necessary documents. This includes proof of mutual fund, proof of ownership, and detailed economic projections. It's necessary to compile all relevant documents meticulously, as any kind of inconsistencies can result in hold-ups or rejections.

After organizing the documentation, applicants have to complete the DS-160 kind and pay the visa cost. Subsequently, a consular interview should be scheduled, where the applicant will certainly provide their situation and supporting materials to a consular police officer.

Frequently Asked Concerns

Can I Make An Application For an E2 Visa With a Partner?

Yes, you can use for an E2 visa with a companion. Both individuals should satisfy eligibility standards, and the investment needs to be significant. Joint ownership or partnership in the financial investment enterprise is permitted under E2 visa policies.

How much time Is the E2 Visa Valid For?

The E2 visa is originally valid for up to two years. It can be renewed indefinitely, gave the company continues to be functional and satisfies the visa requirements, permitting for continuous investment and continued residency in the U.S.

Can I Work Outside Function Outdoors on organization E2 Visa?

An E2 visa largely permits the owner to work within their very own investment business. Taking part in work check here outside business is typically not allowed unless specifically accredited, as it may threaten the visa's validity.

Exists an Age Limit for E2 Visa Candidates?

There is no details age limit for E2 visa applicants. People need to show their financial investment capabilities and meet other qualification standards, including being a national of a certifying treaty nation to protect the visa.

Can Children of E2 Visa Holders Participate In College in the united state?

Yes, children of E2 visa holders can attend institution in the USA. They are eligible for public education and learning, allowing them to take advantage of the academic possibilities offered to homeowners, cultivating their advancement and combination.

In addition to the financial investment aspect, the E2 visa enables for the addition of family members, including children and spouses, that can go along with the major investor to the United States. The financial investment quantity is an important component of the E2 visa qualification criteria, as it straight influences an applicant's capacity to establish a viable organization in the United States. The E2 visa does not state a specific buck quantity for the investment; nevertheless, the investment should be significant in relation to the price of the organization. Establishing the resource of funds for an E2 visa financial investment is an essential facet of the application procedure, as it guarantees that the financial investment is legitimate and deducible. Additionally, investments in concrete properties like equipment, supply, or real estate utilized in the service are identified as qualifying financial investments.